Understanding your Landlord statement

Your landlord statement gives a clear overview of your property’s financial activity. It shows how much rent has been received, what’s been deducted (like fees or repairs), what’s been paid to you and what remains. Invoices are included for transparency and do not include additional charges. Our guide below walks you through each part to help clarify things. If you still have questions, please don’t hesitate to contact the team.

Understanding your rental statement

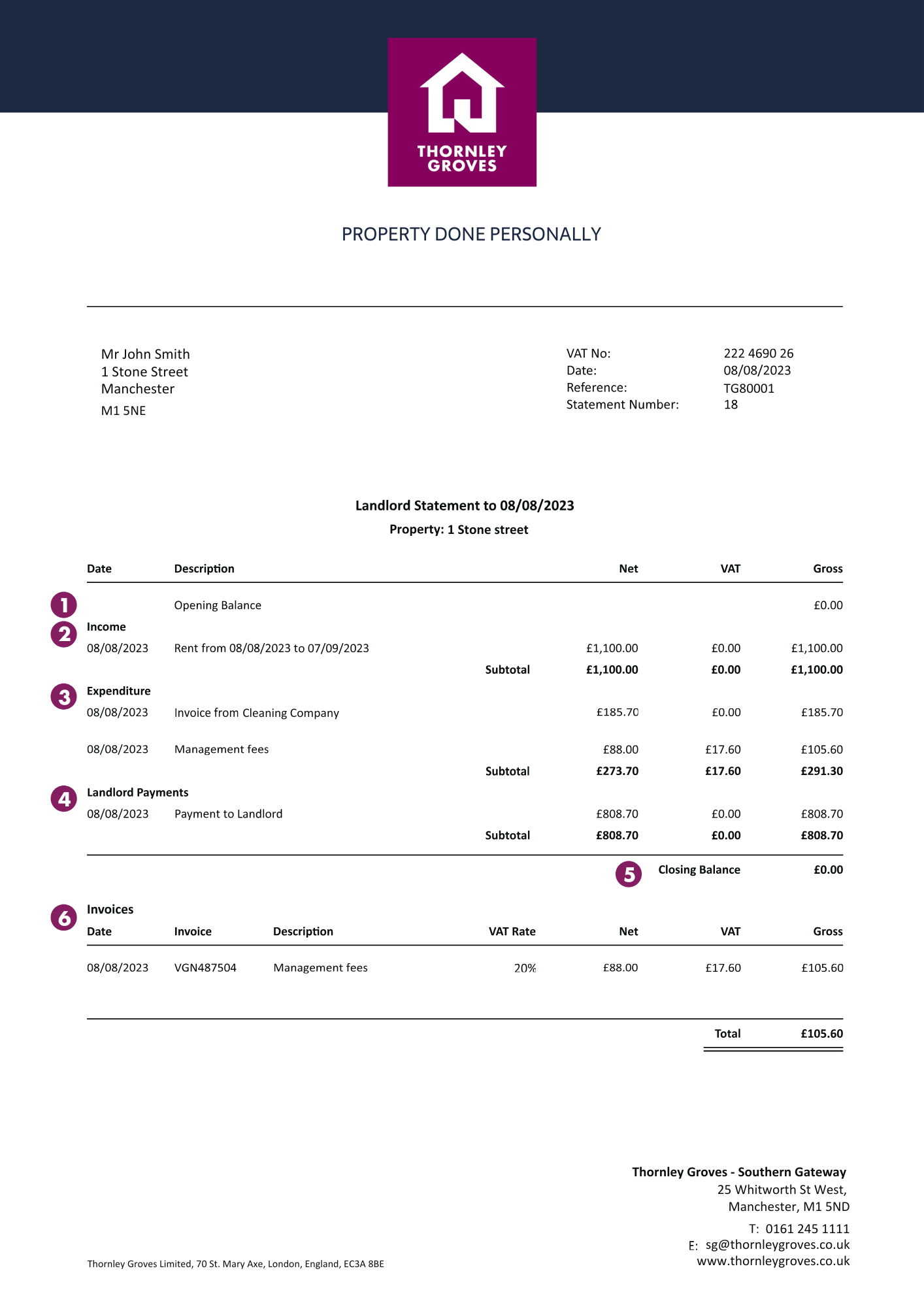

1. Opening Balance – This is the balance carried forward on the landlord’s account from the previous statement.

2. Income – The income section shows income received. For overseas landlords, it will also show any tax credits.

3. Expenditure – This section shows expenditure that has been deducted from income, such as management fees, supplier invoices, and withheld tax.

4. Landlord Payments – This section shows payments that have been made into the landlord’s bank account.

5. Closing Balance – This shows the funds that are left on the landlord account at the end of the statement. This includes any interest earned, funds on account for works and float withheld.

6. Invoices – Highlights all invoices raised against the landlord. This section provides more information on the invoices that also appear in the payments section of the statement. It also provides an invoice number for the landlord to use for accounting purposes. It is not a duplicate or additional charge.

Should you have any further questions regarding your statement, please do not hesitate to contact the accounts department on accounts@thornleygroves.co.uk.

To access your statements, log into your Propertycloud account > click on the documents tab > download your statement directly from there.

Below we’ve provided clear answers to some of the most frequently asked questions from our landlords;

- You may see on your statement a reserve fund/float on your account, however this is nothing to worry about. We are simply holding money towards some planned works which your property manager or the compliance team notified you of. However, if you are unsure why this has been retained it would be best to reach out to your allocated property manager.

- A 'partial rent payment' may show on your statement and this will be when the tenant(s) have only paid part of their rent. We pay our landlords Monday to Friday once we have cleared funds in our account (unless otherwise agreed). As soon as the remaining rent is received, it will be forwarded to you.

- If you receive a partial rent payment, the full management fee will still be deducted. As managing agents, we charge fees based on the total rent due, not the amount received. Rest assured, when the remaining rent is paid, no additional fee will be charged.

- You may notice a repair charge on your statement that you weren't made aware of - this is likely because, under your terms of business, your Property Manager can authorise works up to £250 + VAT without prior approval. If you're unsure about a specific charge, please contact your property manager directly.

- If you would like your annual statement sent, please email clientaccountsteam@thornleygroves.co.uk. Please note charges do apply. If you don’t wish to pay, then our monthly statements are still sufficient for tax purposes.

If you have any additional queries or concerns, please contact the relevant teams or your property manager.